DYNA-MAC HOLDINGS LTD.

2016 ANNUAL REPORT

102

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2016

31.

FINANCIAL RISK MANAGEMENT

(CONT’D)

(b) Credit risk (Cont’d)

(ii) Financial assets that are past due and/or impaired

(Cont’d)

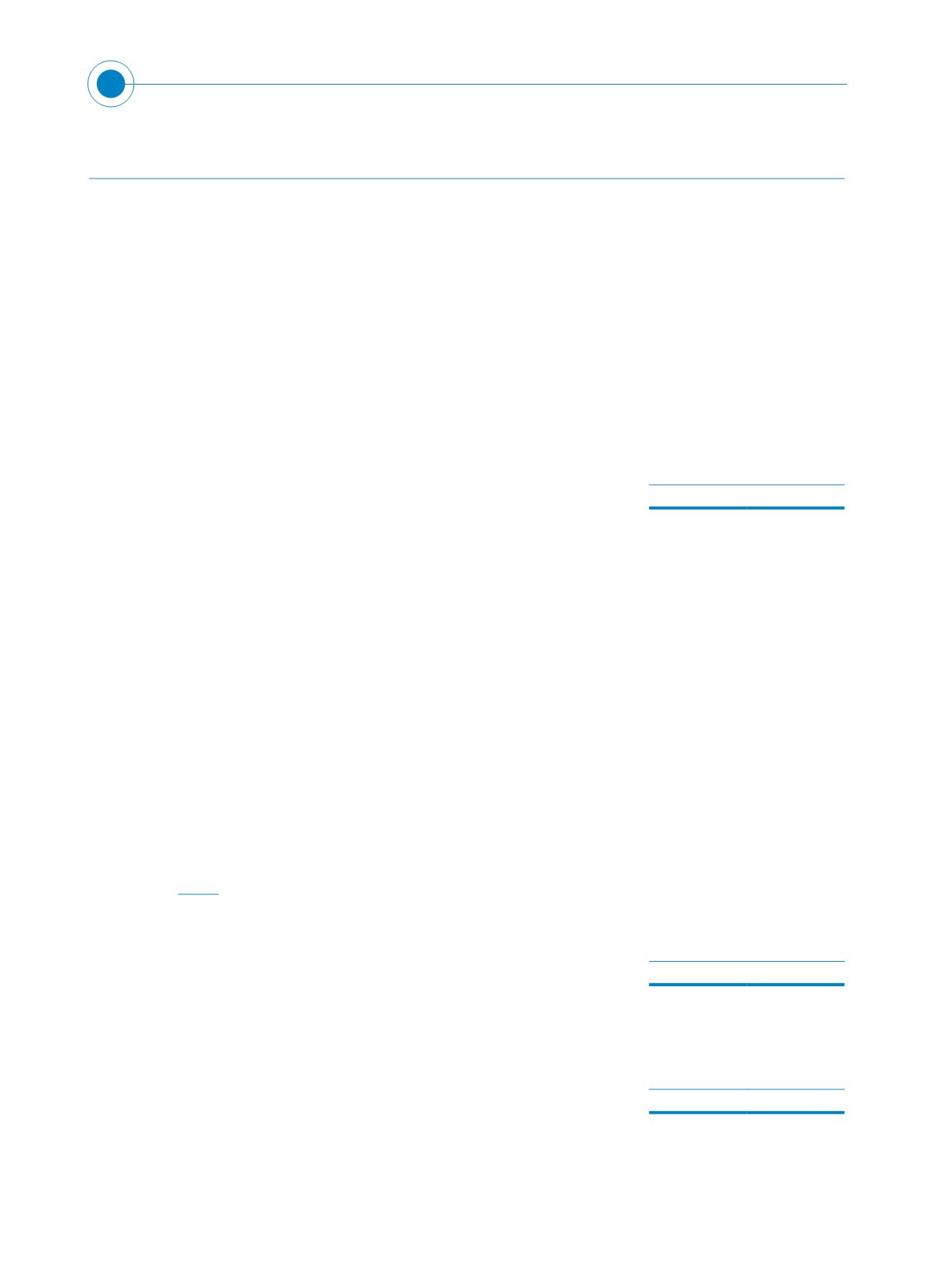

The age analysis of trade receivables past due but not impaired is as follows:

Group

2016

2015

$’000

$’000

Past due up to 3 months

17,592

10,680

Past due 3 to 6 months

7,041

5,791

Past due over 6 months

6,650

8,485

31,283

24,956

The Company is not exposed to significant credit risk as there are no trade receivables due to

the Company at the balance sheet date.

(c) Liquidity risk

The Group and the Company manages its liquidity risk by maintaining sufficient cash and bank balances

to enable them to meet their normal operating commitments.

The table below analyses non-derivative financial liabilities of the Group and the Company into relevant

maturity groupings based on the remaining period from the balance sheet date to the contractual

maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows.

Balances due within 12 months equal their carrying amounts at balance sheet date as the impact of

discounting is not significant.

Less than

1 year

Between

1 and 5

years

$’000

$’000

Group

2016

Trade and other payables*

57,355

–

Bank borrowings

35,000

–

Finance lease liabilities

48

101

92,403

101

2015

Trade and other payables*

100,401

–

Bank borrowings

34,400

–

Unsecured unquoted fixed rate notes

–

53,214

Finance lease liabilities

48

149

134,849

53,363

*

Excludes advances received on construction contracts